Try it now!

Managing your investments has never been easier!

Artificial intelligence has moved from theme to driver across public markets. Picking single winners is a tough game: leadership rotates between software and chips, competitive edges fade, and many leaders already trade at demanding valuations. For most investors, an ETF sleeve is the cleaner way to participate. It spreads exposure across the AI value chain, reduces single-name risk, and makes it easier to manage concentration, costs, and overlap with existing holdings. Much of the recent leadership also reflects an ongoing AI capex boom that continues to reshape chips and infrastructure.

This guide breaks down the most liquid and investable AI ETFs, explains how they differ on focus, concentration, and fees, and shows portfolio builds that add real diversification while avoiding hidden overlap.

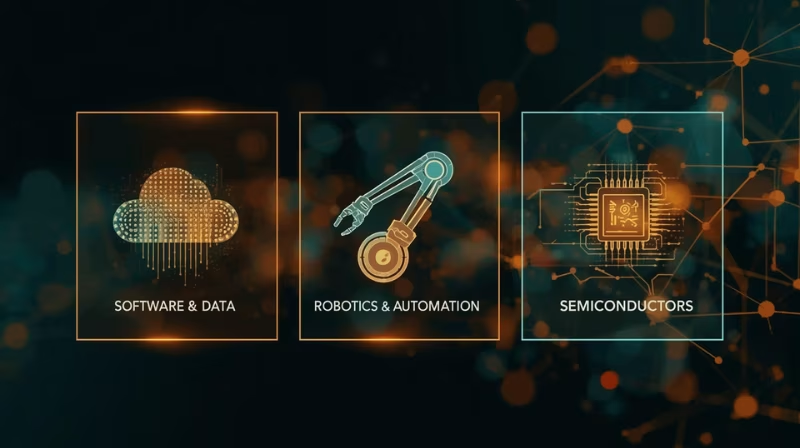

The AI value chain breaks into three investable layers. The ETFs highlighted below are approved by 8FIGURES AI.

These are the most direct way to own AI monetization in software and services—model providers, analytics, data infrastructure, and AI-enabled applications.

Notable ETFs in this category:

Investor angle: Own a diversified basket of companies that build and monetize AI software across many sectors, so you participate in the theme even if any one model or vendor falls behind. This gives you broad upside to AI adoption while reducing single-name risk and the need to pick a winner.

These funds emphasize robotics, machine vision, surgical systems, drones, and autonomous platforms, benefiting both from AI adoption and real-economy capex (reshoring, logistics automation, aging demographics).

Investor angle: Capture AI as it turns into factory lines, warehouses, and operating rooms—drivers that don’t always move with software cycles.

No matter who wins the model wars, everyone needs more compute. Semi ETFs are the cleanest way to express that view —higher beta, but tightly linked to the AI build-out.

Investor angle: Own the compute backbone that powers every AI workload, while using XSD to tame single-name risk that can build up in cap-weighted funds.

Liquidity and cost. The funds above are widely traded, typically charging in the 0.35%–0.95% range. For long holds, small fee differences compound, for tactical sleeves, spreads and volume matter just as much.

Concentration. Check the top-10 weight. BOTZ and SMH can be top-heavy, which is great when leaders run sharper on drawdowns. ROBO and XSD spread risk more evenly by design.

Methodology. Cap-weighted products lean into winners (and concentration). Tiered or equal-weight approaches trade some momentum for breadth. Read the index summary before assuming two “robotics” or two “semiconductor” funds will behave the same.

What recent cycles imply: In 2023–2025, software/platform and semiconductor baskets tended to lead, reflecting rapid model rollouts and data-center buildouts. Applied AI/robotics lagged at times as factory and hospital deployments moved more slowly. When industrial capex improves, leadership can rotate, so the diversification benefit comes from mixing these categories, not stacking look-alikes. Past performance does not guarantee future results.

Pure-play AI (AIQ/ARTY/WTAI) tilts toward software/platform leaders, U.S. megacaps plus select non-U.S. names, giving you direct participation in AI monetization. Overlap among these funds can be meaningful, pairing two similar baskets doesn’t always improve diversification.

Applied AI & robotics (BOTZ/ROBO/ROBT) brings Industrials and Healthcare into the mix, intuitive diversifiers inside the AI them, with BOTZ notably more concentrated than ROBO.

Semis (SMH/SOXX/XSD) are the most cyclical and the most directly tied to the data-center buildout. Adding XSD to a cap-weighted core helps reduce reliance on a handful of megacaps.

Takeaway: Diversification within AI comes from mixing categories, not from stacking two similar “pure-play” funds, and within semis by pairing cap-weighted (SMH/SOXX) with equal-weight (XSD).

Before combining funds, pull each holdings file. Buying two similar baskets can double exposure to the same megacaps. If you already hold NVDA directly, add up the look-through weight across every ETF. Accidental concentration is the most common mistake.

This captures software monetization, real-world deployment, and chips—three distinct levers that rarely peak in unison, while XSD smooths the cap-weighted concentration.

Set explicit rebalance rules (e.g., quarterly with drift bands) so you’re not trading headlines. Match fees and liquidity to your holding period.

To tailor these builds to your portfolio, run them through 8FIGURES for a quick diagnostic on positions, diversification, and next rebalancing steps.

There isn’t a single “best” AI ETF because AI isn’t a single market. Software and data platforms, applied robotics, and semiconductors move on different clocks and respond to different drivers. Building across the stack, rather than doubling up on look-alike funds, gives you cleaner exposure and fewer blind spots.

In practice, that means pairing a diversified software fund with targeted satellites in robotics and chips. In this lineup, WTAI offers a broader, liquid software tilt, while XSD complements SMH/SOXX to curb single-name risk in semis. Keep concentration visible, check overlap before you add, and let a simple rebalance rule handle timing. You can track these ETFs and monitor exposure and overlap in the 8FIGURES App.

REFERENCES

Managing your investments has never been easier!